Oleh: Daniel Pories Sitinjak

PT Bank Negara Indonesia (Persero) Tbk

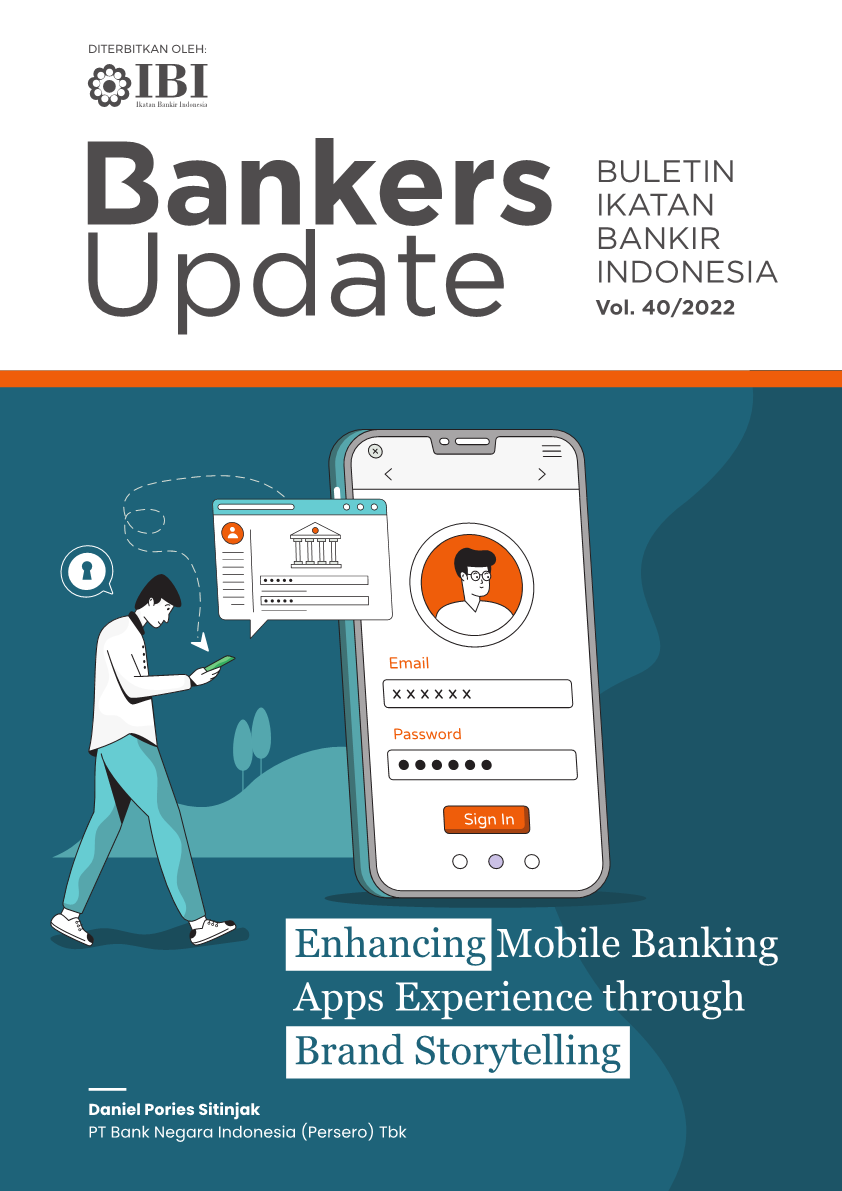

M obile banking apps have become one of the most prominent parts of the banking

system and have grown rapidly in Indonesia. Based on data from Central Bank of

Indonesia (BI), digital banking transaction in Indonesia has increased by 46.72% (y-oy)

in September 2021. It can be seen that mobile banking apps have been widely adopted in

Indonesia and they continue the positive trends in the future. Such reports were also found in

several large banks in Indonesia. For example, BNI and BCA reported growth in the use of mobile

banking apps by 54.2% and 37.1% (y-o-y) respectively. Therefore, it attracts newer competitors

that offer new business model and strategy, such as digital banking companies and e-wallet

service providers.

On Renée’s term, an industry that was once a “blue ocean” industry suddenly shifted into a “red

ocean” industry. To deal with this tight competition, bankers must provide value-added services

to enhance the customer experience and loyalty. One of the value-added strategies that has a

huge potential to be exploited is Brand Storytelling.

With nearly identical mobile banking services, bankers will face difficulties to make people pay

attention to their apps only by using classic promotional strategies (such as ads and gimmics).

Therefore, Smith & Wintrob (2013) suggest that we must build the brand (especially mobile

banking brand) by using compelling stories. These stories, if made right, can turn a brand into a

national sensation that reach into the hearts of like–minded individuals.

For example, some financial technology service providers tend to use attractive and colorful

UI/UX in order to “tap” Millennial and Gen Z customers. They also apply friendly and personalized

languages to help new customers in using the applications. Such companies are proven to be the

market winner as they have bigger transaction value and better application rating. Conversely,

there are several service providers that failed to employ the same strategy. They introduced a

fresh “look” to their mobile banking applications to follow the existing trends without syncing with

the customer needs.

To gain upper hand on this digital banking competition, banks need to employ the Brand Story

Framework. The framework is applicable toward both retail and wholesale segments. However,

this essay will be focused on the retail segment, as wholesale segment requires more

personalized approach toward each client.